Saturday, March 7, 2020

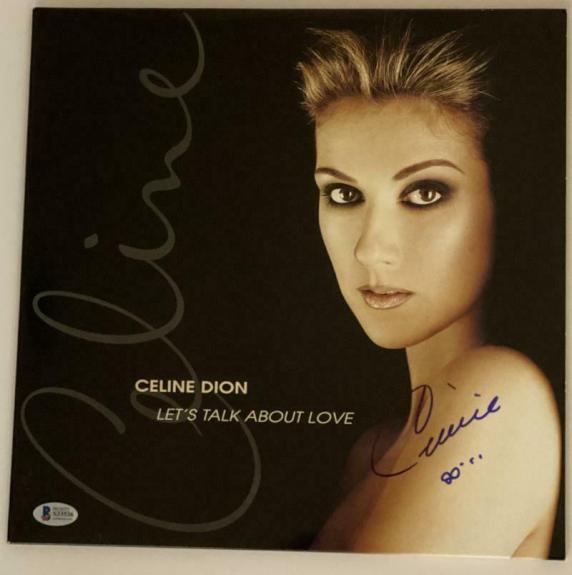

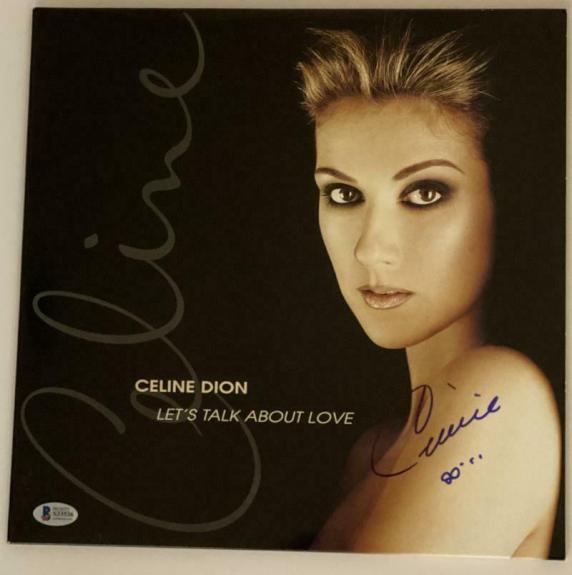

Autograph Memorabilia Exhibition

You can now commission the curating and exhibition of your memorabilia in one stop platform,it will boost you personal branding,yes we work for you,see sample projects below

For more catlogue,logon to

You can now commission the curating and exhibition of your memorabilia in one stop platform,it will boost you personal branding,yes we work for you,see sample projects below

For more catlogue,logon to

|

For more catlogue,logon to

For more catlogue,logon to

For more catlogue,logon to

For more catlogue,logon to

For more catlogue,logon to

For more catlogue,logon to

Why you Invest in Memorabilia

It's all a matter of differentiating between the fly-by-night stars and the long-term investments, those individuals and events that will be remembered decades from now. These are the Blue Chip investments.

Reasons to invest

Growing demand: Today's celebrity driven culture ensures a huge demand for memorabilia, prompting values to surge for the key players in film, music and royalty.

Diversity: Investing in memorabilia is one of the most unlimited and varied collectibles categories - with endless opportunities for you as an investor.

Finite supply: Growing demand is met by a finite supply of props, as the increasing use of computer-generated effects has led to a shortage of tangible items from movie studios.

For many of the vintage-era films, props were simply destroyed as the market for movie memorabilia had not yet been established.

Hollywood love affair: Blockbuster auctions such as the $18.6m Debbie Reynolds collection of Hollywood memorabilia in 2011 reveal collectors' growing passion for the best in vintage movie collectibles.

Royal approval: 2012's diamond jubilee celebrations, witnessed by 3.5bn around the world, helped boost the popularity of the British royal family, and with it their collectibles. A July 2012 poll found that 80% of Britons had a favourable opinion of the current Queen, up from 74% in January.

The birth of Prince George to the Duke and Duchess of Cambridge has further bolstered this popularity, with the family constantly in the media spotlight.

China's sports fans: The sports memorabilia market is worth around $5bn pa in the US, while China's increasingly prosperous economy is producing growing numbers of wealthy individuals keen to invest in collectibles from the sporting world's major stars.

The 2008 Beijing Olympics has ignited the market for sports collectibles in mainstream China, with state media reporting in 2012: "a handwritten invitation letter for the National Games from the 1930s sold for 600 Yuan in 2002, [but] is now worth at least 5,000 Yuan."

Pleasure: There is the added pleasure of investing in an item of history that you can enjoy on a daily basis.

Historical performance

o Movie memorabilia

Marilyn Monroe's "subway" dress from The Seven Year Itch sold for $5.6m in June 2011, becoming the most valuable item of movie memorabilia ever sold. The dress had last auctioned in 1971 for $400, a 27% pa rise in value over 40 years.

A pair of Monroe's earrings showed a 5.6% per annum rise in value in April 2014, selling for $185,000.

The piano used in Casablanca sold for $602,500 in 2013, making a 5.9% per annum increase in value.

James Dean signed photographs have soared in value from £1,600 ($2,540) to £15,000 ($25,177) since 2000, at the rate of 18.79% pa, according to the PFC40 Autograph Index.

The best film Oscar award presented to David O Selznick for Gone with the Wind sold for $1.54m in 1999, a world record for an Oscar.

o Music memorabilia

According to the PFC40 Autograph Index, Madonna's signature rose in value by 8.05% pa between 2000 and 2012, from £375 ($595) to £950 ($1,510).

A signed red leather jacket, worn by Michael Jackson in the 1983 Thriller video, made $1.8m at a US auction in June 2011.

In 2013, a copy of the Beatles' Sgt Pepper's Lonely Hearts Club Band album, signed by John, Paul, George and Ringo, achieved $290,500 - making it the world's most valuable Beatles signed album.

o Royal memorabilia

Queen Victoria's mourning outfit sold for £6,200 ($9,720) in July 2012, beating its £2,000 high valuation by 201%.

PFC Auctions, our sister company, sold the first slice of cake from Kate and Wills' wedding for £1,917 ($3,030) in May 2012.

The dress that Princess Diana wore as she danced with John Travolta at the White House set a record when it sold for $362,500 in March 2013.

Signed photos of Diana rose in value by 16.35% pa between 2000 and 2012, from £1,250 ($1,910) to £8,950 ($14,225), according to the PFC40 Autograph Index.

o Sports memorabilia

Muhammad Ali's gloves from his 1964 fight with Sonny Liston sold for $385,848 in December 2012, raising the world record for boxing memorabilia by 122.9%.

The gold medal won by Jesse Owens at the 1938 Olympics sold for $1.4m in 2013, setting a new record for Olympic memorabilia.

The earliest known New York Yankees jersey worn by Babe Ruth holds the record for any item of sports memorabilia, selling for $4.4m in 2012.

Thinking of investing in memorabilia?

- why Investing in Memorabilia

logon to for details

==========================================================

Subscribe to:

Posts (Atom)